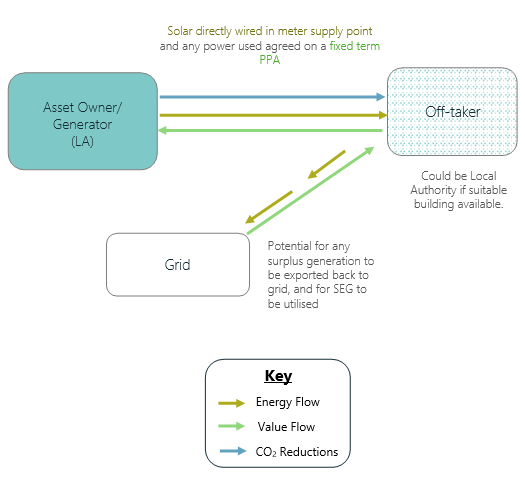

In the private wire business model, a solar asset is directly connected to the point of offtake and electricity generated is used to satisfy site demand

In the private wire business model, a solar asset is directly connected to the point of offtake and electricity generated is used to satisfy site demand. Surplus solar generation is exported to the power grid.

|

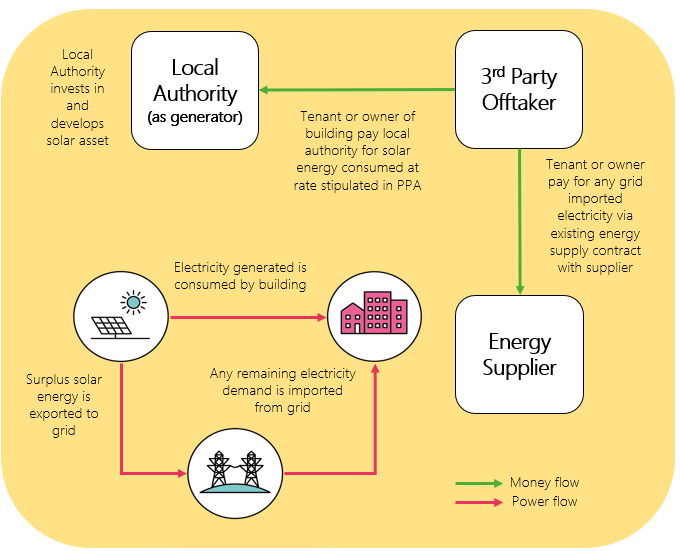

A private wire is sometimes referred to as a ‘Behind the Meter (BtM) PPA This model can be enacted by local authorities as follows:

|

|

|

|

Key BenefitsFinancial and CO2

Other Benefits

|

Risks and Considerations

|

Suitable for

- Technology – primarily solar, storage could be included in future

- Schemes with a large baseload which is guaranteed over time

- Sufficient network and grid connection capacity, so that the off- taker does not incur any upgrade costs

- Suitable land needs to be available in the area, where generation can be placed close to demand and create limited issues in terms of planning consent for the private wire

Contracts Required

- Direct PPA – if the generator and off-taker are different parties

- Contract with Electricity Supplier – off-taker contracts with electricity supplier for balance of electricity

- DNO – Grid Connection Offer and agreement to be in place

- Construction & Legal – construction contract for generation, installation and for “Private Wire”. Legal contracts to fulfil third party land rights and H&S

- Operational – Operational contracts for running and maintenance of “Private Wire”

Contractual Considerations

- Specifying the requirements for the private wire is a specialist skill and will require a proper engineering review of the proposed route to identify additional challenges

- It is likely that the generator would be an exempt supplier under the Supply Licence Exemption Rules – but specialist advice on this should be sought by the project

- Connection arrangements can become complex as the generator will generally not be allowed to connect to the grid other than at the off- taker’s site

Business Model

Viability

Viability

Cost Structure and Revenue

In a private wire arrangement, a solar generation asset is directly connected to the source of off-take.

In a private wire arrangement, a solar generation asset is directly connected to the source of off-take.

This is different to the Sleeved PPA model where power is first exported to the grid and then ‘sleeved’ to the offtaker.

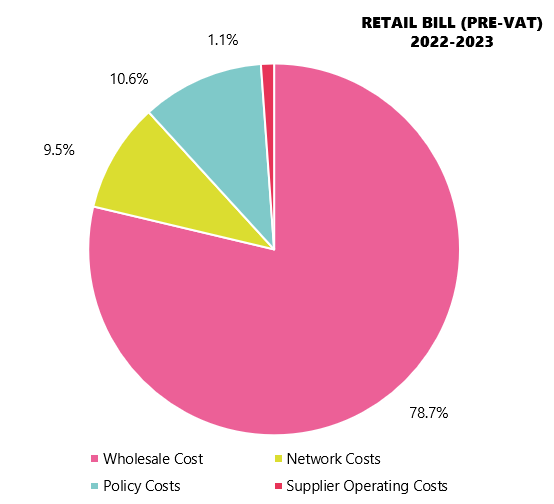

A private wire connection offers cost-savings on the wholesale cost of electricity. – Under current regulations, additional cost-savings may also be achieved by avoiding network charges and environmental and social obligation (policy) costs.

To illustrate these cost-savings, the pie chart on the right highlights components that make up a retail electricity bill in terms of their percentage contribution.

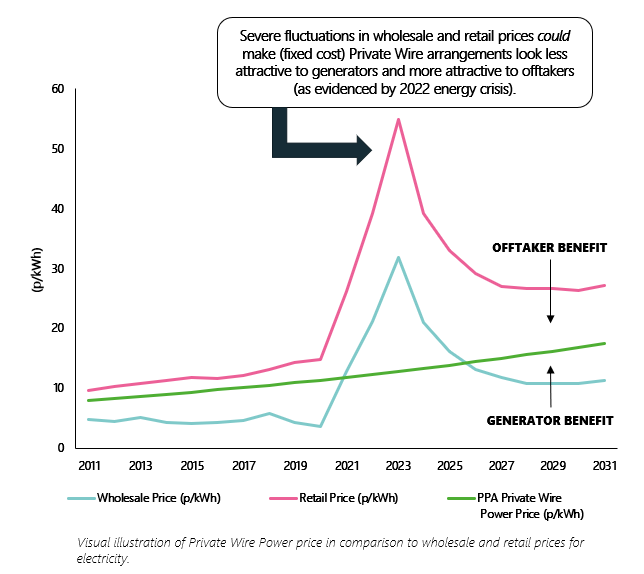

When setting the price for a private wire PPA, the benefits of these savings are shared between the generator and the offtaker. The generator should generate more revenue than if they were trading on the wholesale market and the offtaker should pay a lower price for electricity than what they would as per their existing retail electricity bill. The generator’s revenue will be used to pay financing (loan repayment) and operational costs.

Please note that these component costs are not fixed. The percentages shown may differ year on year. This diagram is for illustrative purposes only.

When negotiating how the benefits from cost avoidances should be shared between the generator and offtaker, the following factors should be considered:

1.What IRR is required by the generator?

- If a high IRR is required, the private wire power price will be closer to the retail price.

2.What cost-savings are required by the offtaker?

- If the goal is to maximise cost-savings for the offtaker, the private wire power price will likely be closer to the wholesale price.

3.Will there be a ‘take or pay’ clause stipulated in the contract?

If so, this could reduce the financial risk for the generator and, in turn, a lower private wire power price may be negotiated

Generator Benefit

- Generator receives payment for power generated; referred to as the ‘Private Wire Power Price’. This should be greater than the wholesale cost of electricity on a p/kWh basis.

- Like the Sleeved PPA model, at times, this price may look less attractive than the wholesale price for electricity.

- When generation is greater than demand, additional revenue may be generated by exporting surplus energy to the grid. This will require an additional export agreement.

Offtaker Benefit

- Offtaker pays for electricity at a price that is higher than the wholesale cost of electricity yet still lower than the retail price of electricity.

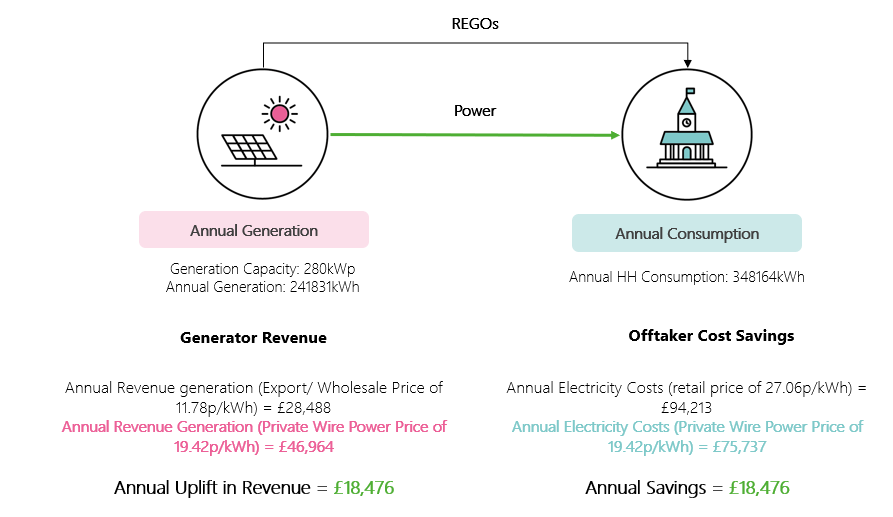

An Example

- Using data from an example project, the image below illustrates the potential financial benefits of the Private Wire business model for both the generator and offtaker.

- The cost avoidance benefits are shared 50:50 between both Parties.

- For simplicity, it is assumed that 100% of the power generated is used to satisfy ~69% of the site’s total demand. However, as mentioned, this would not be the case due to seasonal variations in both solar generation and power demand.

Other Considerations for viability

- The commercial viability of private wire business models can be enhanced by the avoidance of policy and network costs

- This means that the business model is exposed to policy and regulatory risk

- Several initiatives that may influence the level of cost avoidance achieved through private wire projects in future are outlined in the table to the right

- Although it is not yet known how these initiatives (and their possible outcomes) may influence the commercial viability of private wire projects, it is important for local authorities to stay up to date on policy changes that may impact the business model

- It is also important that commercial models for private wire projects are frequently updated to reflect any changes to policies and regulations

|

Initiative |

Brief Summary |

Retail Bill Electricity Bill Component of Relevance |

|

DESNZ – Review of Electricity Market Arrangements (REMA) (DESNZ, 2023a) |

The wide-ranging review will identify reforms needed to transition to a decarbonised, cost effective and secure electricity system. |

Policy and Network Costs |

|

DESNZ – Electricity licence exemptions call for evidence (DESNZ, 2023b) |

This call for evidence seeks to understand how exemptions are currently being used and whether changes are needed to reflect policy aims, in particular, ensuring all market participants (including licence exempt) pay their ‘fair share’ of policy and network costs. |

Policy and Network Costs |

|

DESNZ – Powering Up Britain Report (DESNZ, 2023c) |

UK government committed to outlining a clear approach to gas vs. electricity ‘rebalancing’ by the end of 2023/4 and should make significant progress affecting relative prices by the end of 2024. |

Policy Costs |

|

Transmission Network Use of Systems Charges (TNUoS) Task Force (Charging Futures, 2022) |

The Task Force will examine various aspects of TNUoS methodology, including which elements of TNUoS charges should be paid by distributed generators with a clear, system-based rationale for any differences in treatment between classes of generators. |

Network Costs |

|

Ofgem – Distribution Use of System Charges (DUoS) Significant Code Review (Ofgem, 2022) |

The review will consider numerous aspects of DUoS, including principles and trade-offs in network charging; distributional impacts, vulnerability, and fairness; and what signals get sent and to whom? |

Network Costs |

Feasibility

Feasibility

Key Partnerships

|

Generator |

|

|

DNO |

|

|

Funding/ Finance Provider |

|

|

Offtaker |

|

|

Energy Supplier (and/or other BRP) |

|

|

Delivery Contractor |

|

|

Legal Advisor |

|

|

O&M Contractor |

|

|

Decommissioning Contractor |

|

Partner Arrangements

To enact this model, a private wire agreement between the generator and offtaker that stipulates key terms (e.g., power price, volume and contract duration) will be required.

An additional commercial agreement between the generator and a balancing responsible party (BRP) will be required for any surplus solar energy exported to grid.

If the asset is under 5MWp, it may be eligible for Smart Export Guarantee.

Potential offtakers will be identified during site selection activities – this may or may not be a local authority owned site.

- The opportunity for a local authority to secure a private wire arrangement as an offtaker will depend on the proximity of the local authority’s site to the renewable generation site and how well generation and energy demand profiles are matched.

Contract Length

Because the solar generation asset is directly connected to the source of consumption, viability of the private wire business model is primarily dependent the price paid for energy by the offtaker across the lifetime of the asset.

This means that long-term contractual arrangements (c.15 years) are often required.

- Please note that although contracts have ranged up to 15 years in the past, more recently, they have been shorter.

- Long-term contracts can provide revenue certainty but may be harder to obtain under current market conditions.

Energy Volume Considerations

The generator should make clear to the offtaker the anticipated volume of energy that will be supplied to the site (taking variability and asset degradation into account).

- To reduce supply risk, the offtaker may wish to include a ‘minimum supply volume’ clause in the contract that outlines penalties for the generator if the asset does not perform as expected.

It is also possible that the offtaker’s energy demand profile may change over time (due to operational changes or the installation of energy efficiency technologies).

- To minimise revenue risk, the generator may wish to include a ‘take or pay’ clause in the contract.

- This means that the offtaker would agree to a stipulated volume of energy and pay a penalty if it is not consumed onsite

Key Activities and Key Resources

Site Selection and Grid Connection

When identifying potential site locations for private wire schemes, the length of the private wire connection required is a crucial factor to consider.

- Costs for a 1km private wire connection can be up to £250k* (see Appendix 3) (Energy Local Scotland, 2020).

It is also important to know the energy demand of potential sites that are being considered to understand how well energy generation and demand are matched.

- It is good practice to perform calculations, to understand the percentage of self-consumption, as accurately as possible (and as soon as possible in the design process) to minimise any unforeseen costs (i.e., due to potential resizing requirements) and to avoid unnecessary project delays.

For private wire installations, consideration needs to be given to where the scheme will connect to the grid (e.g., at the offtaker’s site or at the generation site).

The most common arrangement is for the grid connection point to be located at the offtaker’s site.

This means that the offtaker can still have a separate supply arrangement with an energy supplier which may be required for the following reasons:

- To supply energy to match any site demand that can’t be met by solar asset output.

- To account for any planned (or unplanned) shutdowns.

Where this is the case, the generator should consider what contingencies they need to have in place should access to the grid connection point become no longer available (i.e., the offtaker moves premises).

If the grid connection point is located at the generation station, the DNO may require this to become the offtaker’s only point of electricity supply (Welsh Government Energy Service, 2021).

- This could result in energy supply risks for the offtaker (depending on how well-matched generation and demand profiles are).

Energy Supply

Licencing

- To supply electricity to an offtaker, via Private Wire, the generator would either need to be a licensed electricity supplier or fall under one of the exemptions in The Electricity (Class Exemptions from the Requirement for a Licence) Order 2001 (HM Government, 2001).

- Legal support will be required to determine whether compliance has been met and which Class exemption is applicable.

Excess power generation

- There may be times that excess power is generated from the solar asset and needs to be exported to the grid.

- This will require a separate export agreement with a balancing responsible party.

- If the solar asset is under 5MWp, it may be eligible for Smart Export Guarantee (SEG) (OFGEM, 2023).

- As an alternative to SEG, the generator may secure a PPA with an energy supplier for solar export.

- Some local authorities have secured an export arrangement for their aggregated surplus solar at a rate higher than most SEG providers.

- Soft market testing with suppliers will be required to ensure that the best possible rate (p/kWh) is obtained for surplus solar export.

End of the arrangement

- At the end of the private wire arrangement, the offtaker may not wish to renew the contract.

- In this case, the generator may choose to export all solar energy to the grid by securing an export agreement with a balancing responsible party.

- This could be a complex process if the grid connection is under ownership of the offtaker.

- For example, the generator may be required to pay rent or usage fees to continue using the connection point.

Desirability

Desirability

Value Proposition, Customer Relationships, Customer Segments, Channels

Value Proposition, Customer Relationships, Customer Segments, Channels

Local Authority as Generator

|

Desirability Checklist |

Considerations |

|

|

Revenue Generation |

Do you value revenue generation more than reducing costs? |

|

|

How much do you value the opportunity to maximise revenue generation potential? |

|

|

|

Price Certainty |

Do you value revenue certainty? |

|

|

Risks |

Are you comfortable with risk? |

|

|

Resource Requirements |

Do you have the resource and expertise available to deliver renewable generation projects? |

|

|

Do you have access to legal support? |

|

Local Authority as Offtaker

|

Desirability Checklist |

Considerations |

|

|

Cost Savings |

Do you value cost savings more than generating revenue? |

|

|

How much do you value the opportunity to maximise cost-savings? |

|

|

|

Price Certainty |

Do you value cost certainty? |

|

|

Risks |

Are you willing to take on some risk? |

|

|

Resource Requirements |

Do you have access to legal support? |

|

Local Authority as Offtaker and Generator

If the local authority assumes the role of generator and offtaker, the private wire business model would essentially become a self-consumption and export model where:

- Commercial viability is primarily dependent on the cost-savings achieved by offsetting grid imported electricity.

- Further revenue may be generated from surplus solar energy that is exported to grid (at a lower price on a p/kWh basis).*

The table below highlights considerations for this arrangement

|

Desirability Checklist |

Considerations |

|

|

Revenue Generation and Cost-Savings |

Do you value both generating revenue and reducing costs? |

|

|

Price Certainty |

Do you value price certainty? |

|

|

Risks |

Are you willing to take on some risk? |

|

|

Resource Requirements |

Do you have the resource and expertise available to deliver renewable generation projects? |

|